Latest Update as per the 26th GST Council Meet held on 10th Mar 2018.

- Inter-state execution of e-way bill to be actualized from first April 2018.

- Intra-state usage of EWB to commence from 15th April 2018 of every a staged way. States to be partitioned into 4 parcels to execute this staged rollout.

The E-WayBill portal gives an unbroken gateway to generate eWay bills, change car wide variety at the already generated ewaybill, cancel generated ewaybills and many more…

E-WayBill in EWB-01 may be generated by way of either of techniques:

- At the web

- Through SMS

This topic covers the step of producing the eway bills on online E-WayBills portal.

There are some pre-necessities for producing an E-WayBills:

- Registration on the EWB gateway.

- The Invoice/Bill/Challan identified with the relegation of merchandise must be close by.

- If transport is by road – Transporter ID or the Vehicle number.

- If transport is by rail, air, or ship – Transporter ID, Transport archive number, and date of the report.

Here is a grade by grade manual to Generate E-WayBill (EWB-01) online:

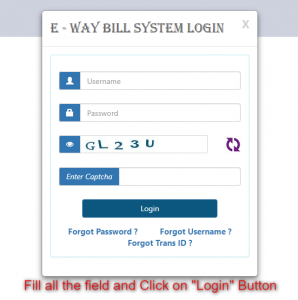

Step 1: Login to E-WayBill Portal.

Click on the login button to enter the Username, Password and Captcha Code then click on ‘Login’

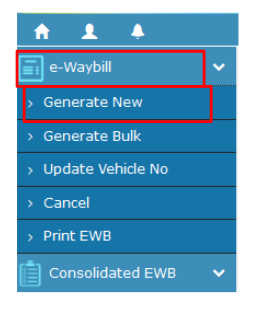

Step 2: Click on ‘Generate new’ under ‘E-WayBill’ option appearing on the left-hand side of the dashboard.

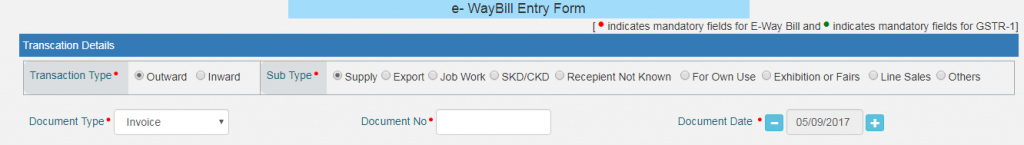

Step 3: Enter the following all the fields on the screen that appears:

1) Transaction Type:

Select ‘Outward’ on the off chance that you are a provider of dispatch

Select ‘Internal’ on the off chance that you are a beneficiary of dispatch.

2) Sub-type: Select the significant sub-type applicable to you:

On the off chance that exchange write chose is Outward, after subtypes show up:

![]()

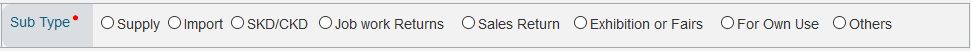

On the off chance that exchange compose chose is Inward, after subtypes show up:

3) Document Type: Select both of Bill/Invoice/challan/credit note/Bill of section or others if not Listed

4) Document No.: Enter the record/receipt number

5) Document Date: Select the date of Document or Invoice or challan.

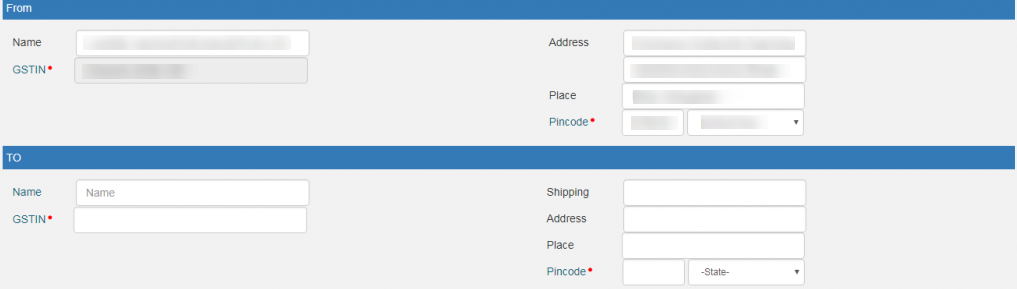

6) From/To: Depending on whether you are a provider or a beneficiary, enter the To/From area points of interest.

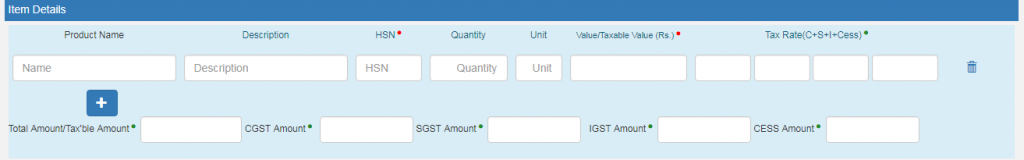

7) Item Details: Add the details of the consignment in this section:

- Product name

- Description

- HSN Code

- Quantity

- Unit

- Value/Taxable value

- Tax rates of CGST and SGST or IGST (in %)

- Tax rate of Cess, if any charged (in %)

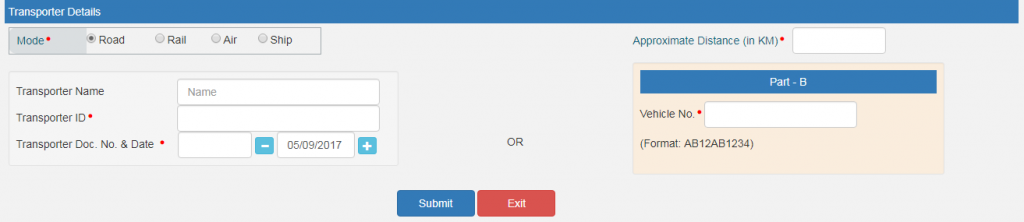

8) Transporter points of interest: The method of transport and the rough separation secured (in KM) should be necessarily said in this part.

Step 4: Click on ‘Submit’. The framework approves information entered and hurls a mistake assuming any.

Something else, your demand is prepared and the E-WayBill in Form EWB-01 shape with a one of a kind 12 digit number is created.

The E-WayBill created resembles this:

Print and convey the EWayBill for transporting the products in the chose method of transport and the chose movement.