As a GST registered dealer, you are required to provide GST Invoices, otherwise called bills to your customers. Here, we will cover the accompanying parts of GST Invoices:

What is a GST Invoice?

A receipt or a bill is a rundown of products sent or administrations gave, alongside the sum due for installment.

Who should issue GST Invoice?

On the off chance that you are a GST enrolled business, you need to give GST-protestation solicitations to your customers available to be purchased of good as well as administrations.

Your GST enlisted merchants will give GST-consistent buy solicitations to you.

What are the obligatory fields a GST Invoice should have?

A tax bill is generally issued to price the tax and skip on the input tax credit. A GST Invoice should have the subsequent mandatory fields:

- Invoice number and date

- Customer name

- Shipping and billing address

- Customer and taxpayer’s GSTIN (if registered)**

- Place of supply

- HSN code/ SAC code

- Item details i.e. description, quantity (number), unit (metre, kg etc.), total value

- Taxable value and discounts

- Rate and amount of taxes i.e. CGST/ SGST/ IGST

- Whether GST is payable on reverse charge basis

- Signature of the supplier

*In the event that the beneficiary isn’t enlisted AND the esteem is more than Rs. 50,000 then the receipt should convey:

- name and address of the recipient

- Address of delivery

- State name and state code

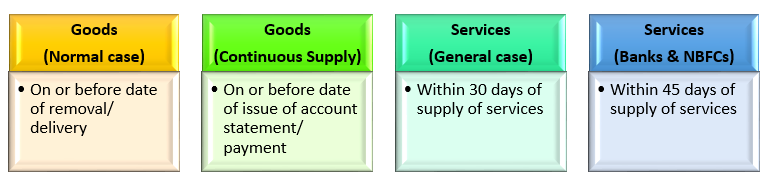

By when would it be advisable for you to issue solicitations?

The GST Act has defined time limit to issue GST assess solicitations, updated charges, charge notes and credit note.

Following are the due dates for issuing a receipt to clients:

How to personalise GST Invoices?

you may personalise your invoice with your business enterprise’s brand. The clean GST lets in you to create and personalise GST bill freed from cost.

What are other types of invoices?

A. Bill of Supply

A bill of supply is like a GST receipt aside from that bill of supply does not contain any expense sum as the merchant can’t charge GST to the purchaser.

A bill of supply is issued in situations where impose can’t be charged:

- Enlisted individual is offering exempted merchandise/administrations,

- Enrolled individual has picked for composition conspire

B. Aggregate Invoice

On the off chance that the estimation of different solicitations is not as much as Rs. 200 and the purchaser is unregistered, the merchant can issue a total or mass receipt for the different solicitations every day.

For instance, you may have issued 3 solicitations in a day of Rs.80, Rs.90 and Rs. 120. In such a case, you can issue a solitary receipt, totaling to Rs290, to be called a total receipt.

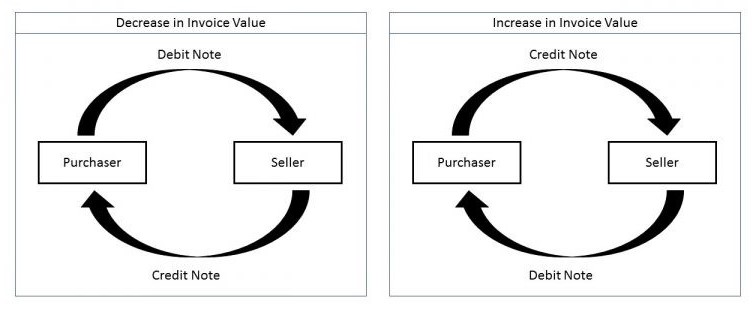

C. Debit and credit note

A debit note is issued by vender when the sum payable by purchaser to merchant increments:

- Expense receipt has a lower assessable incentive than the sum that ought to have been charged

- Assessment receipt has a lower impose an incentive than the sum that ought to have been charged

A credit note is issued by vender when the estimation of receipt diminishes:

- Tax receipt has a higher assessable incentive than the sum that ought to have been charged

- Tax receipt has a higher duty esteem than the sum that ought to have been charged

- Buyer discounts the merchandise to the supplier

- Services are observed to be deficient

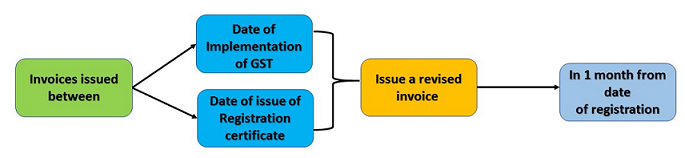

Would you be able to update solicitations issued before GST?

yes. you can revise invoices issued before GST. under the GST regime, all the dealers must observe for provisional registration before getting everlasting registration certificate.

refer to this image below to apprehend the protocol of issuing a revised bill:

This applies to every one of the solicitations issued between the date of execution of GST and the date your enrollment endorsement has been issued.

As a merchant, you should issue a revised invoice against the solicitations as of now issued. The modified receipt must be issued within 1 month from the date of issue of the enrollment declaration.

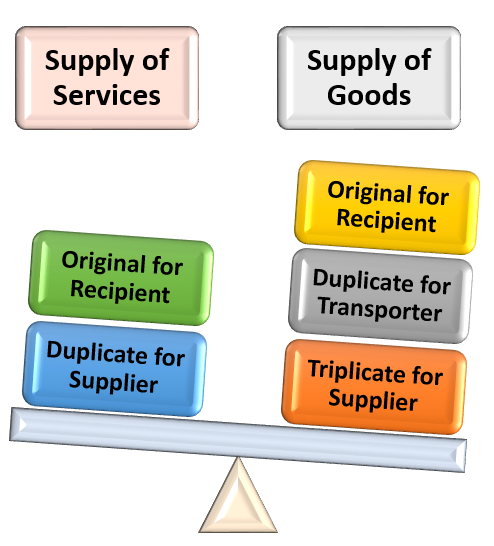

What number of duplicates of Invoices ought to be issued?

- For goods– 3 copies

- For services– 2 copies

GST Invoicing under Special Cases?

At times, such as saving money, traveler transport, and so forth., the administration has provided relaxations on the receipt format issued by the provider.

FAQs on Invoice

1. Is it compulsory to keep up receipt serial number?

Truly, receipt serial number must be looked after entirely. You may change the arrangement by giving a composed suggesting the GST office officer alongside explanations behind the same.

2. What’s the contrast between receipt date and due date?

Receipt date alludes to the date when the receipt is made on the billbook, while the due date is the point at which the installment is expected against the receipt.

3. Would i be able to carefully sign my receipt through DSC?

Truly, you can carefully sign receipt through DSC.

4. How to issue a receipt under switch charge?

If there should arise an occurrence of GST payable under turn around charge, on you should also specify that expense is paid on invert charge, on the GST receipt.