Are you a small business owner or a startup?

If you started your own business. It’s likely that you’re concentrating the work or tasks you love doing.

There is a lot of work for you to do to expand your business. I bet you that you’re not interested in tracking your financial data every time.

Let’s take an example, if you own a retail business, you might have:

- A business model or mission.

- A high transaction rate with a number of customers.

- Many sales a day.

- Invoices for your products.

- Bill/sales records.

- Staff wages to record and pay.

There are a lot of data to track and manage. And I bet you that you don’t want to do it own (if you’re like other successful business owners).

Recording and managing financial data is not something you enjoy. But it’s important to track your data.

Then what to do?

Don’t panic!

That’s where cloud accounting software comes in! It can be your best friend. It can lighten your business load.

What a Cloud accounting software can do for you

The days are gone when businesses had to keep a record book of all the business finances and transactions. We live in the digital era. Everything has changed. The way people buy has changed and the way we do businesses also has changed.

It’s crucial for you to integrate new technologies into your business to make it smarter.

The Cloud accounting software will make your business finances hassle free and make your life easier. It’s a great medium to manage and record your receipts, invoices, bills, and other transaction details, etc.

You must be worried about your financial data security?

Cloud accounting software providers like MindooAccountants offers reliable accounting software with critical security features (which are specifically designed) to keep your data safe and increase your business efficiency.

So you don’t need to worry about your data.

Cloud accounting software also allows you to access your data from anywhere at anytime. And you don’t even need to install any software.

If you want to run your business smoothly, you must invest in cloud solutions.A report identified that an array of industries now owns this new digital innovation – Cloud innovation!

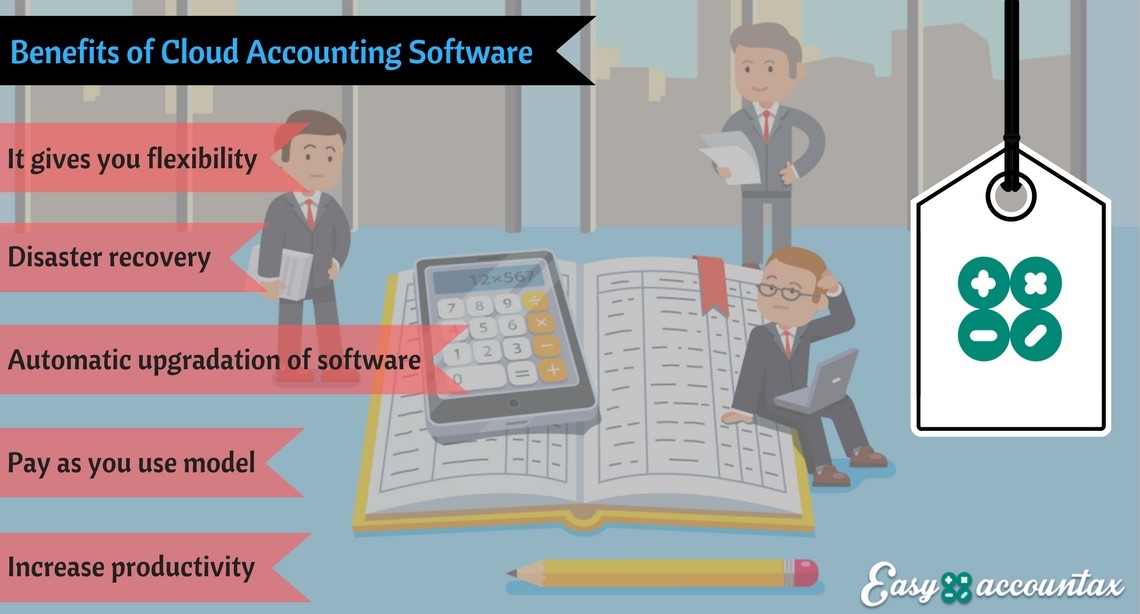

There are a number of benefits of cloud accounting software for your business:

- It gives you flexibility.

- Disaster recovery

- Automatic upgradation of software

- Cost reduction in hardware and software expenses

- Pay as you use model

- Mindooto collaborate with team and clients

- Increase productivity

Are you still wondering, why should you opt cloud solutions for your business? Let’ access some facts:

AWS generated $3.2 billion in revenue in Q3 of 2016 alone – an increase of 55% over the same period in 2015. While Microsoft trail far behind AWS, cloud products are expected to account for 30% of their revenue by 2018. (Source)

U.S.-based organizations are budgeting $1.77M for cloud spending in 2017. (Source)

The Cloud market was valued $148 billion in 2016 and growing by 25% annually. (Source)

50% of businesses indicated they are or will use (within the next 24 months) an industry cloud offering. (Source)

More than 70% of UK businesses are using at least one cloud service.

Ofer Gadish CEO & Co-Founder at CloudEndure predicts that,

“We are going to see many more enterprises migrating to the cloud in 2017. The cloud is finally mature and secure enough for enterprises, and its myriad of benefits outweigh any limitations.”

Now, I hope you understand the importance of cloud accounting software for your business. If you are not cloud, It’s the best time to choose cloud solutions for your business.